Trevor Bisset

Nov 23. 23:49

10 Interval Funds Yielding Over 7% with No Return of Capital: Q3 2021

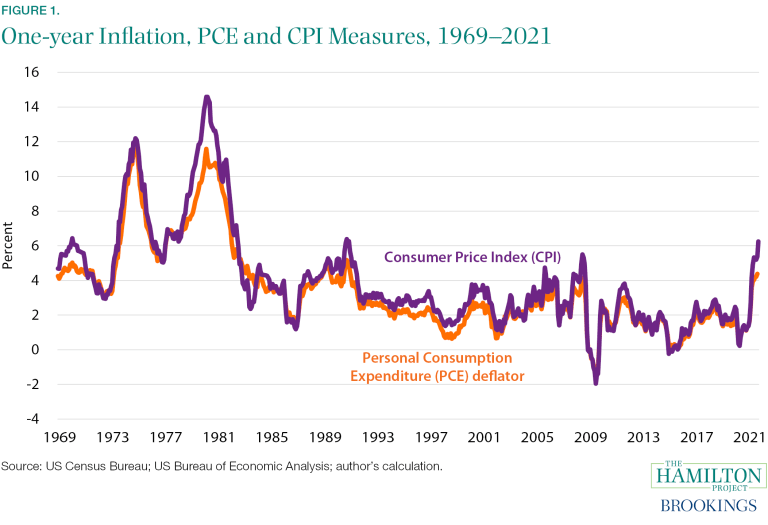

Inflation is top of mind, so yield is top of mind.

We are still riding the longest bull market in stock market history, inflation has surged to 6.2%, and the Fed is not providing clarity on raising rates.

The yield on the 10-year Treasury note just climbed to a paltry 1.629%, TIPS real yields are at an all-time low of -1.196%, and the S&P 500 Dividend Yield is at a 20-year low of 1.29%.

For retirement investors, fixed-income investors, bond investors, FIRE investors, or anybody who feels overexposed to a stock market that appears fully priced, inflation presents a tough challenge: watch my income erode steadily, or stay in riskier positions while attempting to protect my downside?

This is a great time to remind people that interval funds exist. They can get you exposed to high-yielding private market investments with low stock market correlation, and right now there are 10 interval funds yielding over 7% with no return of capital.

They're all involved in private credit.

What's Wrong With Return of Capital?

Return of Capital ("ROC") is a distribution from a fund that involves returning a share of your ownership back to you, rather than paying dividends out of the fund's net investment income.

It's not considered taxable income, but it does reduce the cost basis of your initial investment – meaning if you sell those shares for a profit later, you'll have higher realized capital gains liability than if you hadn't received ROC distributions.

It also reduces the amount of fund shares you own, meaning that NAV/share income distributions will also be reduced proportionally. It's somewhat antithetical to buy high-yield funds on a long-term buy-and-hold strategy if your ownership keeps getting handed back to you, reducing your income.

Finally, ROC is effectively forcing you to sell shares at NAV. Maybe you'd like to #hodl onto your income-producing investment without regularly looking for ways to reinvest the capital it returns to you...or having your RIA charge fees to do that work on your behalf.

10 Interval Funds Yielding Over 7% with No Return of Capital

We appreciate the income-focused interval funds that manage to pay attractive yields with 0% ROC in their distributions.

Without further ado, here are 10 interval funds yielding over 7% without forcing you to take your shares back.

10. First Eagle Credit Opportunities Fund – Class I Shares (FECRX) – 7.05% Current Yield

The Fund is focused on alternative private credit with an emphasis on generating current income. Private credit and alternatives will be a theme in this piece.

If you can't stomach a $1,000,000 minimum initial investment, the Fund's Class A Shares (FECAX) only require $2500 upfront, and still pay a 7.045% current yield.

Minimum Initial Investment: $1,000,000

YTD Total Return: 9.42%

Net Expense Ratio: 1.82%

Return of Capital: 0%

9. Carlyle Tactical Private Credit Fund – Class N Shares (TAKNX) – 7.13% Current Yield

The Fund is focused on generating current income by investing in a wide range of credit strategies.

$250,000 might be a steep minimum initial investment for some, but the Fund's Class A Shares (TAKAX) can be had for $10,000 upfront, and still pay a 6.667% current yield.

Minimum Initial Investment: $250,000

YTD Total Return: 10.42%

Net Expense Ratio: 4.70%

Return of Capital: 0%

8. Invesco Dynamic Credit Opportunity Fund – Class AX Shares (XAXCX) – 7.22% Current Yield

The Fund is the first to convert from an existing traditional closed-end fund ($VTA), and not only offers exposure to opportunistic private credit strategies, it offers shareholders the ability to redeem shares at NAV – not bad when $VTA has been trading at a discount for years.

There's no minimum investment for Class AX Shares, as all Class AX shareholders had their $VTA shares converted to Class AX shares this year. The lesson here is, if you're holding traditional closed-end funds that feature NAV growth and have been trading at a persistent discount, you should keep an eye out for an activist-led conversion.

Minimum Initial Investment: N/A

YTD Total Return: 13.44%

Annualized Total Return Since Inception: 5.66%

Net Expense Ratio: 2.35%

Return of Capital: 0%

7. KKR Credit Opportunities Portfolio – Class I Shares (KCOPX) – 7.40% Current Yield

This Fund is all about earning strong current income while protecting your downside. Thus far, they have achieved this via investments in both public and private credit with an opportunistic focus.

Minimum Initial Investment: $1,000,000

YTD Total Return: 5.67%

Net Expense Ratio: 2.99%

Return of Capital: 0%

6. BlueBay Destra International Event-Driven Credit Fund – Class I Shares (CEDIX) – 7.43% Current Yield

The Fund is focused on multi-strategy and event-driven credit instruments both foreign and domestic to achieve capital appreciation and current income. The Sub-Adviser, BlueBay Asset Management, did well enough in achieving the Investment Objective that Destra renamed the Fund to include their brand in summer of 2021.

$100,000 isn't a feasible minimum initial investment for many, but you can get into their Class A Shares (CEDAX) for $2500 and still collect a 7.18% yield.

Minimum Initial Investment: $100,000

YTD Total Return: 14.84%

Net Expense Ratio: 2.33%

Return of Capital: 0%

5. BlackRock Credit Strategies Fund – Investor A Shares (CRDAX) – 7.76% Yield to Worst*

The Fund seeks to provide strong income and attractive risk-adjusted returns by investing in public and private corporate credit.

*Yield to Worst is different from Current Yield, in that it measures the worst yield a bond can deliver without default. We couldn't find a reliable Current Yield for CRDAX, so we provided the next best option. It's notable that private credit funds tend to focus on borrowers of strong credit quality, so while we won't advise anyone to ignore the risk of default, we can point out historical default and delinquency rates in private markets that are significantly lower than public credit with equivalent yield.

This Fund didn't differentiate between share classes in terms of yield, so we showed you the one with the lowest upfront minimum and the best net expense ratio.

Minimum Initial Investment: $2500

Annualized Total Return Since Inception: 6.41%

Net Expense Ratio: 3.36%

Return of Capital: 0%

4. PIMCO Flexible Credit Income Fund – Institutional Class Shares (PFLEX) – 8.07% Current Yield

Have you noticed a pattern?

Private credit + interval funds = yield. This Fund aims to provide risk-adjusted returns and current income by investing across a wide array of global credit sectors, including corporate debt, mortgage-related and other asset-backed instruments, collateralized debt obligations, government debt, municipal bonds, and debt issued in emerging markets.

Once again, if a million upfront feels too concentrated (or just impossible currently), you can buy into Class A-2 Shares (PFALX) for $2500 and collect a 7.58% yield.

Minimum Initial Investment: $1,000,000

YTD Total Return: 10.11%

Annualized Total Return Since Inception: 7.77%

Net Expense Ratio: 2.30%

Return of Capital: 0%

3. AlphaCentric Prime Meridian Income Fund – Shares of Beneficial Interest (PMIFX) – 9.27% Current Yield

We have officially entered the "too good to be true" tier, where investors unfamiliar with private credit are immediately skeptical that this much yield could be associated with such low volatility. It's fairly common if you know where to look. You just can't buy it on Robinhood.

The Fund is yet another private credit play, aiming to drive current income through exposure to marketplace lending – specifically, consumer, small business, and real estate loans originated on the internet.

Minimum Initial Investment: $10,000

YTD Total Return: 5.61%

Annualized Total Return Since Inception: 7.83%

Net Expense Ratio: 2.41%

Return of Capital: 0%

2. Angel Oak Strategic Credit Fund – Class I Shares (ASCIX) – 10.62% Current Yield

It's not a typo. ASCIX is delivering over a 10% yield with no ROC, and the net expense ratio of 0.76% makes this fund truly unique among actively managed interval funds.

Once again, this is private credit. Corporate debt, RMBS, CMBS, CLOs, and residential loans and mortgages.

$50,000 may seem steep for a minimum initial investment, unless you've been paying into a retirement account for a few decades and you're facing down an income scenario based off <2% Treasury yields.

Minimum Initial Investment: $50,000

YTD Total Return: 9.85%

Annualized Total Return Since Inception: 6.10%

Net Expense Ratio: 0.76%

Return of Capital: 0%

1. Flat Rock Opportunity Fund – Common Shares (FROPX) – 11.63% Current Yield

For the second quarter in a row, FROPX is our yield winner. The Fund is focused on income generation, and offers exposure to a diversified pool of first-lien senior secured loans. Read: private credit.

This Fund has not only outperformed the S&P 500 index YTD on total return, it pays over nine times the dividend with no return of capital. The fee structure is hefty, especially with an incentive fee on an interval fund, but the results speak for themselves.

Minimum Initial Investment: No minimum limit contribution when accessed through the custodial platforms. DST may enforce a limit for someone that wishes to purchase via subscription documents, however.

YTD Total Return: 25.11%

Annualized Total Return Since Inception: 15.10%

Net Expense Ratio: 5.49%

Return of Capital: 0%

Methodology

We calculate current yield by annualizing a fund's latest distribution, then dividing it by the fund's NAV at the time of that distribution.

It's not a perfect method – at least at scale – as NAV and distributions can change over time, plus it may accidentally incorporate one-off capital gains distributions, and some funds pay at irregular times that aren't reflected in their prospectuses. Plus, interval fund registration statements are decidedly not apples-to-apples in terms of labels and formatting.

Still, it's a start, and a strong current yield can indicate which interval funds are worth taking a closer look at. Mainly you're looking for steady NAV growth, no ROC, and other factors that might impact your own investment choices/advice based on individual goals.

It's not as simple as selecting filters on Morningstar. We'll show you how we did it, then give you a better option.

Option 1: Reinvent the Wheel

Step 1: Record the Distribution Frequency from the prospectus of each active interval fund. It helps to have an existing database of active interval funds, and it helps to have great Ctrl + F muscle memory if you're going with Option 1.

Step 2: Run a script that grabs the most recent per-share distribution and NAV on that distribution date, then appends suspected yields onto each ticker using the calculation above. It helps to have a colleague who is awesome at Python if you're going with Option 1.

Step 3: Spot-check each interval fund whenever an active fund has no yield, when yield is over 8%, or when yield is suspiciously low for a reputable income fund. You can use resources like Bloomberg or Yahoo Finance as additional opinions. It helps to be familiar with the aforementioned fund database if you're going with Option 1.

If it were scalable and pretty, someone would have built IntervalFunds.org years ago. Source: IntervalFunds.org

Step 4: Sort by Current Yield, open the CIK page for each ticker on Edgar, find the latest N-CSR (or N-CSRS) and confirm that distributions over the last period were entirely from net investment income.

When distributions from net investment income = total distributions, that's how you know. Source: FROPX

Step 5: If a fund checks out for 0% ROC, cross-reference it with NAV performance and fees to make sure it isn't too good to be true.

Option 2: Use Available Resources

Step 1: Follow @interval_funds on Twitter for updates on new content, or subscribe to our mailing list in the footer.

Step 2: When we publish research articles, read them.

Moral of the Story: When Inflation Snowballs, Pay Attention to Credit-Focused Interval Funds

It's all there in the public record, assuming you know where to look and have time on your hands.

If you care about yield, credit-focused interval funds are worth your time to explore – and we're here to make that process easy for you.

Have research requests? Drop us a line at alpha@intervalfunds.org or DM us on Twitter at @interval_funds.

Similar from Intervalfunds

View All

Interview (Part 1 of 2): The USQ Core Real Estate Fund Passes the $100 Million AUM Benchmark

Trevor Bisset

Feb 08. 00:39

Interview (Part 2 of 2): The USQ Core Real Estate Fund Passes the $100 Million AUM Benchmark

Trevor Bisset

Feb 22. 12:35